[ad_1]

Nobel prize winner Daniel Kahneman handed away at the moment. His work incorporating psychology into economics by way of Prospect Principle has been a serious advance. From the N.Y. Instances obituary:

Professor Kahneman delighted in declaring and explaining what he known as common mind “kinks.” Crucial of those, the behaviorists maintain, is loss-aversion: Why, for instance, does the lack of $100 harm about twice as a lot because the gaining of $100 brings pleasure?

Amongst its myriad implications, loss-aversion idea means that it’s silly to test one’s inventory portfolio regularly, for the reason that predominance of ache skilled within the inventory market will probably result in extreme and presumably self-defeating warning.

Loss-aversion additionally explains why golfers have been discovered to putt higher when going for par on a given gap than for a stroke-gaining birdie. They fight more durable on a par putt as a result of they dearly wish to keep away from a bogey, or a lack of a stroke.

For a superb introduction of Kahneman’s contribution, one can learn the ebook Pondering, Quick and Gradual. Extra technically, Prospect Principle helped to resolve a few of the key paradoxes in anticipated utility idea. From the Nobel Prize web site:

Departures from the von Neumann-Morgenstern-Savage expected-utility theories of choices underneath uncertainty had been first identified by the 1988 economics laureate Maurice Allais (1953a), who established the so-called Allais paradox (see additionally Ellsberg, 1961, for a associated paradox). For instance, many people desire a sure achieve of three,000 {dollars} to a lottery giving 4,000 {dollars} with 80% likelihood and 0 in any other case. Nonetheless, a few of these identical people additionally desire profitable 4,000 {dollars} with 20% likelihood to profitable 3,000 {dollars} with 25% likelihood, regardless that the chances for the positive factors had been scaled down by the identical issue, 0.25, in each options (from 80% to twenty%, and from 100% to 25%). Such preferences violate the so-called substitution axiom of expected-utility idea…

One putting discovering is that individuals are usually far more delicate to the best way an end result differs from some non-constant reference stage (akin to the established order) than to the result measured in absolute phrases. This concentrate on modifications moderately than ranges could also be associated to well-established psychophysical legal guidelines of cognition, whereby people are extra delicate to modifications than to ranges of out of doors circumstances, akin to temperature or gentle.

Furthermore, folks look like extra adversarial to losses, relative to their reference stage, than attracted by positive factors of the identical measurement.

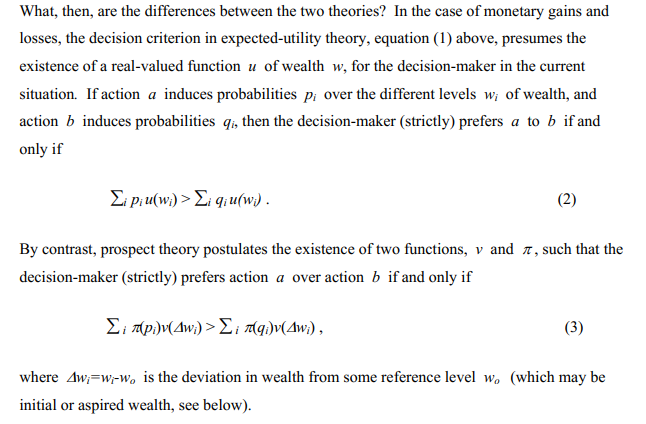

And a few of the arithmetic behind prospect idea:

The important thing variations between anticipated utility and prospect idea: (i) anticipated utility cares about ranges whereas prospect idea evaluates modifications in opposition to establishment [i.e., w vs. Δw], (ii) prospect idea permits the utility operate and danger preferences to for positive factors relative to losses [i.e., u(w) vs. v(w)] ], and (iii) anticipated utility idea takes chances as given whereas prospect idea makes use of choice weights which account for a way people understand these chances [i.e., p vs. π(p)].

Whereas Prospect Principle probably represents real-world human decision-making processes extra precisely than anticipated utility idea, some criticisms of Prospect Principle can be that (i) with repeated video games, people usually revert to nearer to an anticipated utility framework and (ii) for researchers, figuring out a ‘establishment’ worth for every particular person is usually difficult in observe.

However, the Nobel Prize was a lot deserved and the scientific contributions Kahneman (and his collaborator Amos Tversky) will stay on for posterity.

[ad_2]